Contents:

The owner’s capital account adjustments can serve to account for any changes in ownership, allocation, or distribution of profits and losses during the course of operations. As a single member LLC, if you pay personal expenses directly with your business profits, you’ll pierce the corporate veil. To maintain liability protection , you need to pay yourself through distributions.

After following all your advice we are now legal, and I am working on finding a good accountant to help us with the taxes and the rest of the financials. So far, we’ve discussed the default income tax rules for LLCs, but things can get more complicated. The members of an LLC can choose for the business to be classified as a C-corporation or S-corporation for tax purposes.

This will make sure the business taxes are filed according to the law. If you haven’t done so yet, you’ll want to consider what form your business will take. This is why it’s important to keep capital accounts straight when filing taxes and preparing financial statements.

Create an Operating Agreement

In order for a business owner to withdraw from an LLC, he must have approval from all other members. If they are not given approval, it results in a withdrawal of funds and will result in the member not having a capital account. The LLC must make appropriate allocations of tax items to capital accounts based on contribution size and a fair market value. The simplest approach for a company to stay organized is to maintain capital accounts for each individual member.

The Schedule K-1 summarizes each owner’s share of LLC income, losses, credits, and deductions. Each owner will attach their Schedule K-1 to their personal income tax return that’s filed with the IRS. There’s a wide range of business taxes that the owners of an LLC might be responsible for. Federal, state, and local income taxes represent the biggest burden for most business owners. The way in which you file and pay income taxes depends on whether your LLC has one owner (a single-member LLC) or multiple owners (a multi-member LLC). As with property, you will need to obtain a market value for the value of your services.

- The other small business accounting software with a totally free version is Zoho Books.

- As with property, you will need to obtain a market value for the value of your services.

- You should commit to a time slot every week during which you know you won’t be interrupted.

- Sometimes LLC owners can pay as much in self-employment and payroll taxes as they end up paying in income taxes.

- Instead, each member pays taxes on the business’s income in proportion to their ownership stake in the LLC.

In essence, it should contain all relevant information pertaining to the operations of your LLC. All online accounting services simplify the accounting process, but there will undoubtedly be times when you have questions. Some apps also provide context-sensitive help along the way and a searchable database of support articles. The user experience was clearly designed for novice bookkeepers who are just starting out, or for established but still small companies that just don’t need many accounting features.

Which Transactions Do Accounting Services Support?

It’s one of the cleanest, most understandable business services available. It supports multiple currencies and has a smart selection of features for very small businesses. It doesn’t have a dedicated time-tracking tool, comprehensive mobile access, or inventory management, though. The LLC then allocates a capital gain or loss as required by law for tax purposes.

That includes annual obligations such as registered agent fees and annual reports. Instead, an LLC gets deemed “anonymous” when the state does not publicly identify its owner. Much about business formation is a matter of public record, and there may be a reason someone would want to try to keep as much of their information private as possible. For instance, a single-member LLC owner may operate out of their home but may not want this fact to be a matter of public knowledge. Once it’s formed, you’ll need to ensure your business remains in good standing with your state.

The amount of taxes you’ll owe to the government is directly connected to your business entity structure. A limited liability company is a type of business that is registered with the state and provides personal liability protection for owners. Your small business is booming, sales are strong and you’re on track for a record year. If you’re asking yourself these questions, it’s time to start working with a professional. Small business accountants have the knowledge to not only guide you through hidden deductions and pesky forms, they will also provide solid advice about planning and projections.

Payroll taxes account for about 15 percent of the first $115,000 of income. The self-employment tax for a limited liability partnership is normally easy to understand if you know how an LLC gets taxed for income tax accounting purposes. By default, your single member LLC is taxed as a sole proprietorship. That means that, even though it’s legally a separate entity from your person, you and your small business are one and the same for income tax purposes and file the same income tax return. Would you like to let customers pay with credit cards and bank withdrawals? Then you need to sign up with a payment processor such as PayPal or Stripe .

How Do Limited Liability Companies (LLCs) Pay Taxes?

Instant search tools and customizable reports help you track down the smallest details and see overviews of how your business is performing. Android and iOS apps give you access to your finances from your mobile devices. Accounting software is a computer program that helps businesses track income and expenses. The software can also be used to generate reports, such as profit and loss statements and balance sheets. Most accounting software programs include features for invoicing, tracking payments and managing inventory.

Schneider Downs Admits Matthew Legg to Lead International Tax … – INSIDE Public Accounting

Schneider Downs Admits Matthew Legg to Lead International Tax ….

Posted: Wed, 19 Apr 2023 16:40:07 GMT [source]

If the LLC has several owners, each owner’s share is determined by agreement, usually a formal operating agreement. Most small businesses don’t need a dedicated employee for accounting. Having a member of your team who handles everything financial might seem tempting, but remember to factor in the salary and benefits you would be responsible for providing. Your two main choices will likely be an accounting firm or an independent accountant who you contract with.

LLC self-employment taxes

In general, capital gains and losses are allocated to individual members according to their percentage of ownership. Here’s a short summary of the single member LLC business structure vs. sole proprietorships. The protection an LLC gives you from liability is often referred to as the corporate veil—a kind of imaginary curtain dividing your personal assets and those of the business.

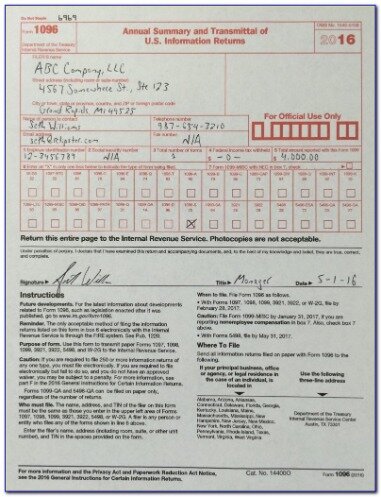

Each member’s bookkeeping boston account records the initial contribution and any additional contributions made during the year. It also records distributions during the year and a final capital account total for the year. For LLCs treated as pass-through entities, one would file documents for the business along with personal tax forms. You will need to submit additional paperwork if the LLC is treated as a corporation. For instance, the IRS would require Form 8832 for LLCs taxed as corporations.

What Is the Best Accounting Software for Small Businesses?

More complex companies can add advanced tools that include projects and proposals, mileage and time tracking, and reports. With its straightforward accounting software, QuickBooks is an easy favorite amongst freelancers, and not just because many of them bundle it when filing their own taxes with its tax software. When choosing a business entity for your company, taxes are paramount.

Fitch Places Fort Jackson Housing LLC Tax Revenue Bonds 2008 … – Fitch Ratings

Fitch Places Fort Jackson Housing LLC Tax Revenue Bonds 2008 ….

Posted: Fri, 21 Apr 2023 16:16:00 GMT [source]

If filed online, it may be possible to get your LLC formed in two to four business days. Otherwise, LLC papers submitted by mail often take two to several weeks to process. Alongside knowing how to start an LLC, there are a few key details to handle that contribute to the success of the new entity or which may serve as additional requirements for running your business. A registered agent is someone who receives official or legal documents on behalf of the LLC. Once received, the registered agent then passes on these documents to the LLC.

Company

It’s also a good idea to browse the accounting software’s settings. All the accounting services reviewed here come with default settings that you may need to change. For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you. We recommend FreshBooks especially for sole proprietors and companies with perhaps an employee or two—though it’s capable of handling more. Very small businesses could use it for basic money management, like sending invoices, monitoring financial accounts, accepting payments, and tracking income and expenses.

One reason is that it keeps things much simpler when it comes time to do your taxes. Another is that you won’t have to go sifting through your checkbook register and receipts to try to remember which expenses were for business purposes. Most small businesses opt to create what is called a Limited Liability Corporation, or LLC. This type of business formation allows the business owner to run the business as an extension of themselves, while still allowing certain liability protections from debts and court judgments. It also keeps business dealings with creditors separate from your personal affairs.

This will ensure that the default chart of accounts provided for your company, and tax line mapping, match your company’s business structure as closely as possible. In order to set up an LLC on Quickbooks, you will need your bank statements , your company’s Employee Identification Number and asset/depreciation schedules. If you use a business credit card or have business debt, you will also want the credit card numbers and current balances.

TAP Innovations Adds Executive Financial Leadership and Accounting Advisory Services – EIN News

TAP Innovations Adds Executive Financial Leadership and Accounting Advisory Services.

Posted: Fri, 21 Apr 2023 00:00:00 GMT [source]

We analyzed these across five primary categories for a total of 20 different metrics. These were then weighted to favor features that matter most to small businesses. Despite these challenges, accounting software can be a valuable tool for businesses of all sizes. When choosing accounting software, it’s important to consider the needs of your business and compare different features to find the best fit. One can choose to use either the accrual basis or cash basis of accounting when initially setting up the accounting system for an LLC. Under the accrual basis, revenue is recognized when earned and expenses when incurred.

It only takes a few seconds to generate a report after you have defined it. The other small business accounting software with a totally free version is Zoho Books. It’s a better choice for anyone who already uses other Zoho software, as well as businesses that plan to grow. For the very smallest businesses, Wave if the best free accounting software.

You want the product to allow room for your business to grow, but you don’t want to spend a lot of extra money on features you may never need. Most of the accounting services we reviewed are available in multiple versions, so you can start at the low end and upgrade to a more powerful edition that looks and works similarly. Once you complete a customer record and start creating invoices, sending statements, and recording billable expenses, you can usually access those historical activities within the record itself. Some accounting programs, such as Zoho Books, display a map of the individual or company’s location and let you create your own fields so you can track additional information that’s important to you. Truly Small Accounting comes from Kashoo, the company that produced Kashoo Classic, which we’ve reviewed for many years.